By Miguel do Rosario, editor of Global South News

While the United States and its Western vassals burn through billions more dollars on a new military front in the Middle East, bombing civilians in Yemen, the Chinese dragon continues to win the economic battle simply by doing business.

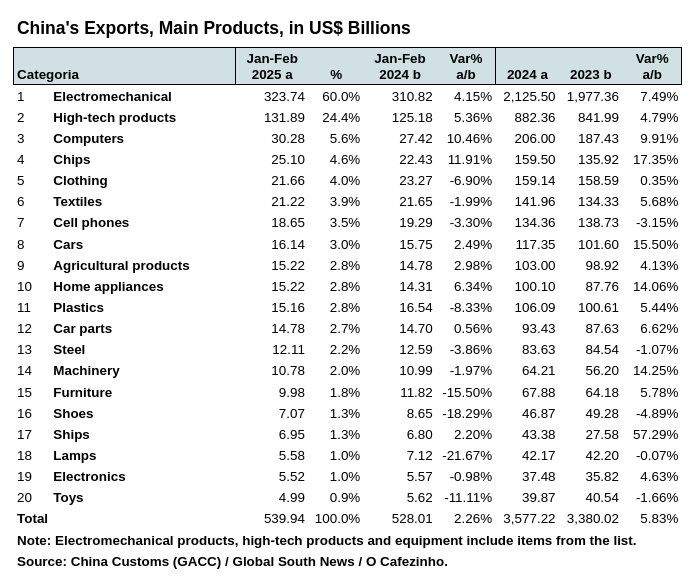

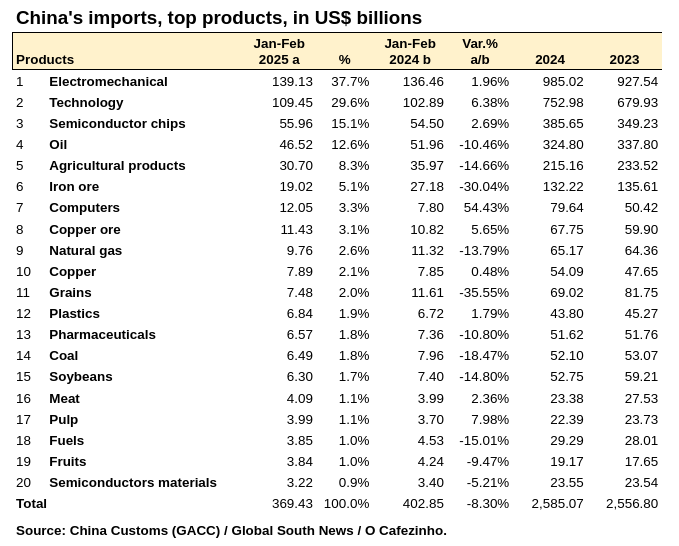

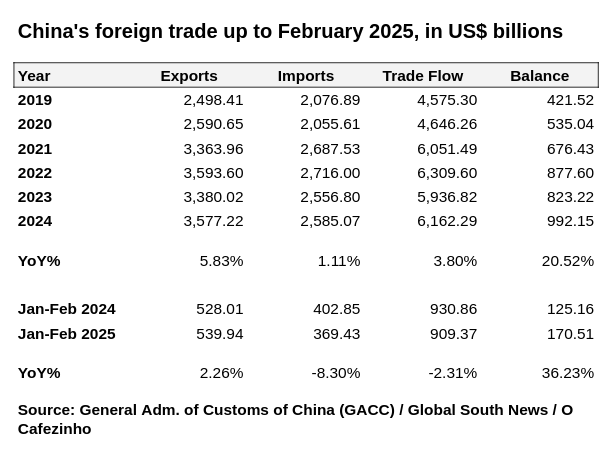

According to exclusive data compiled by Cafezinho and Global South News (the English-language “sibling” outlet of Cafezinho), China’s foreign trade has once again shattered records in the first two months of the year.

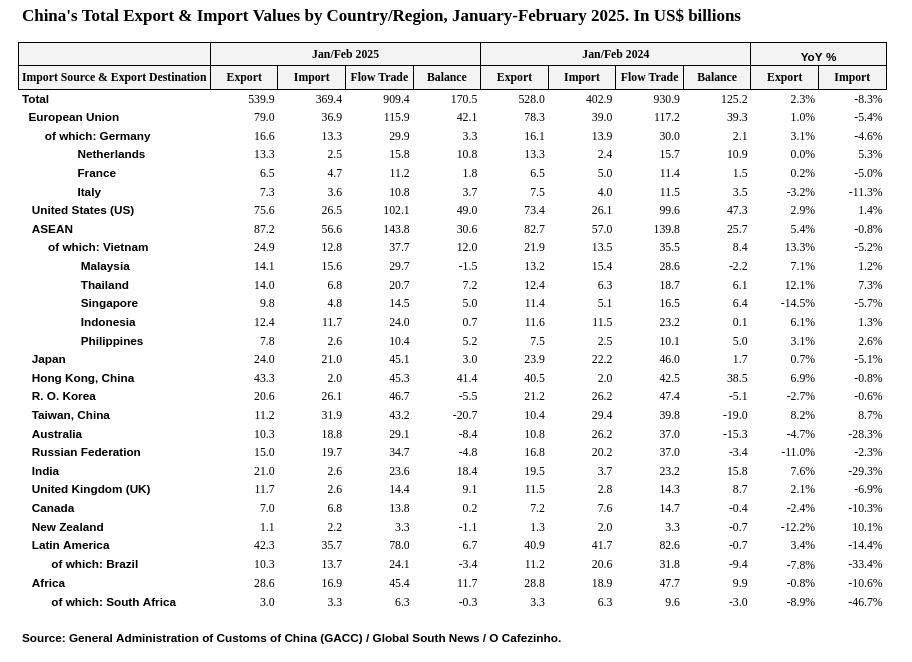

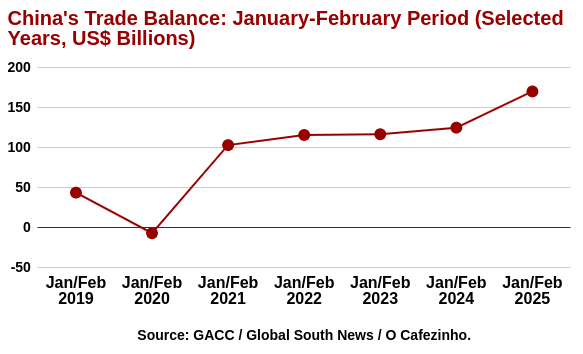

From January to February 2025, China’s total trade volume (the sum of exports and imports) reached $909.37 billion. The country’s trade surplus with the rest of the world in this period hit $170.52 billion, marking a staggering 36% year-over-year increase and setting a historic record.

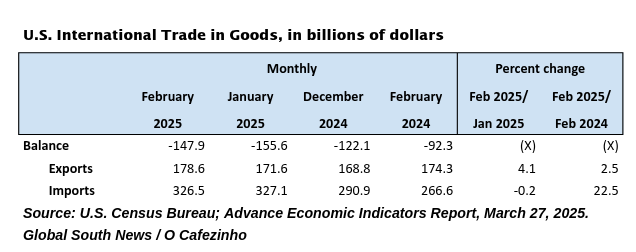

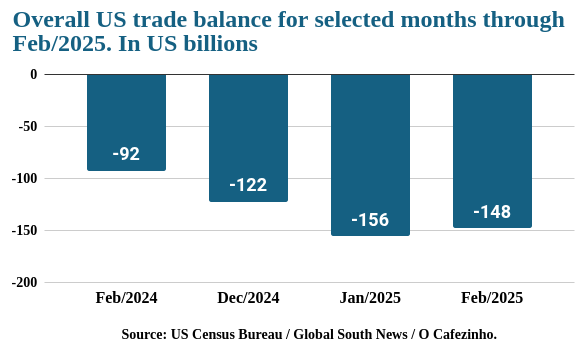

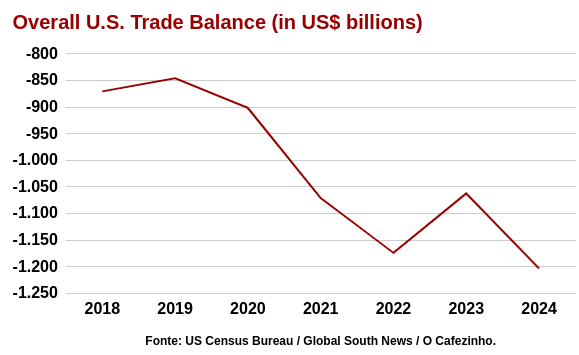

The comparison to the United States is inevitable. Despite indiscriminately imposing sanctions on countless countries and pouring vast sums into industrial policies since Biden’s tenure, the U.S. trade deficit continues to grow.

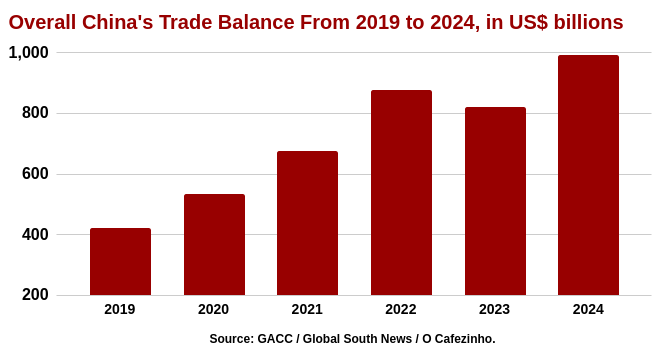

In February 2025 alone, the U.S. trade deficit hit -$155.6 billion—nearly double the -$92 billion deficit recorded in the same month the previous year. But a full-year comparison is more telling. In 2024, China’s trade surplus reached a historic high of nearly $1 trillion, while the U.S. moved in the exact opposite direction, posting a deficit exceeding $1.2 trillion.

This, of course, explains the desperation of the new U.S. administration under Donald Trump and its delusional policy of imposing tariffs on the entire world. The American production system has lost competitiveness and is now trying to claw back ground through sheer noise.

Over recent decades, while the U.S. political elite wasted trillions of taxpayer dollars on pointless wars, China built a high-speed rail network spanning 50,000 km. The U.S. has zero km of high-speed rail.

As the U.S. funds genocide in Gaza (now expanding to the West Bank and Lebanon) and boasts about installing a former Al Qaeda operative to lead Syria, China announces that state-owned chipmaker SMIC has successfully produced a 5-nanometer chip—despite (or rather, because of) all sanctions imposed by the White House. This humiliates the lapdog nations of the Global North, which have lost hundreds of billions in Chinese business only to cling to a losing horse.

Let’s return to China’s trade data, which carries immense weight because the “West” cannot pretend it doesn’t exist or accuse Beijing of distorting numbers through bureaucratic trickery. Falsifying trade statistics is extremely difficult, as the figures must align: Every product China imports from Country X is recorded by both Chinese customs and the customs of the exporting nation.

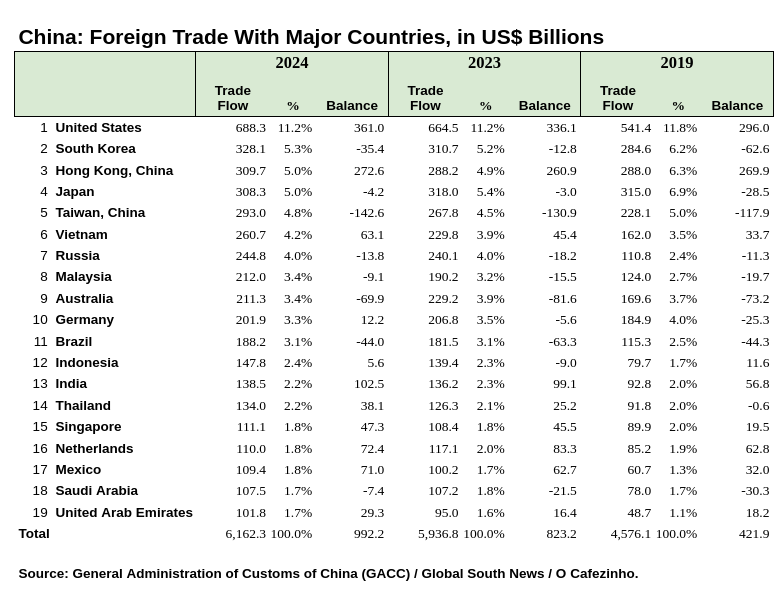

When analyzing China’s key trade partners and its overall foreign trade, two factors stand out. The first is the deep economic interdependence with the United States.

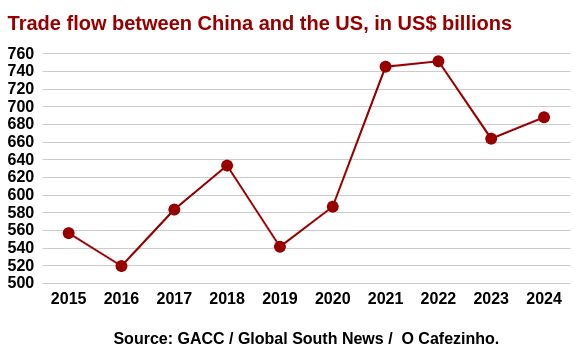

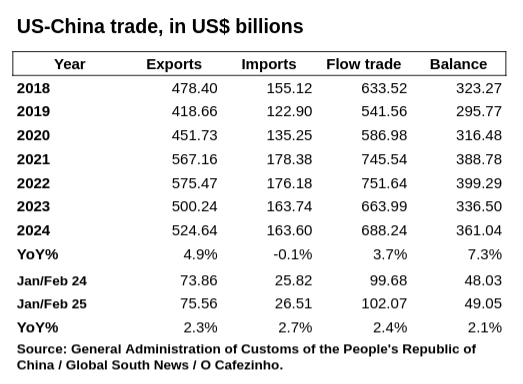

Despite the political screeching from Washington, U.S.-China trade grew in 2024, reaching nearly $700 billion ($688 billion to be exact). The all-time peak, however, occurred in 2022 at $752 billion.

2025 has started strong for bilateral trade, with total volume rising 2.4% year-over-year to $102 billion in the first two months. China’s surplus with the U.S. reached $49 billion, up 2.1%.

The second factor is the Asian pivot of Chinese trade, driven by the region’s economic development. Instead of exporting coups, as the U.S. does in its sphere of influence, China exports high-speed rail, ports, roads, and digital connectivity. With ASEAN alone—the bloc comprising Indonesia, Malaysia, the Philippines, Singapore, Thailand, Brunei, Vietnam, Laos, Myanmar, and Cambodia—China’s trade volume hit nearly $1 trillion in 2024. This dwarfs its $688 billion trade with the U.S. and $785.8 billion with the EU during the same period.

Notably, ASEAN excludes Japan, with which China recorded $308 billion in trade in 2024.

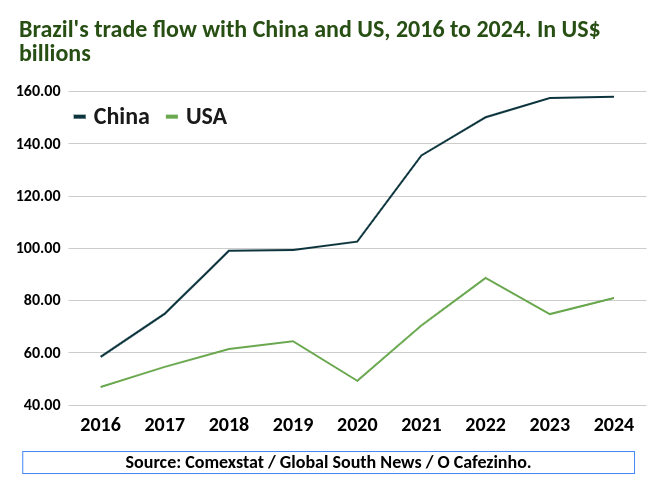

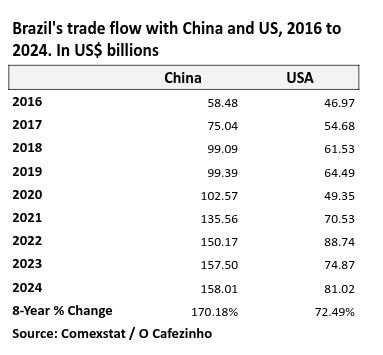

China is using infrastructure investments to cultivate new markets, reducing reliance on the U.S. and Europe. Some of these markets are in Asia, while others lie in Africa and Latin America.

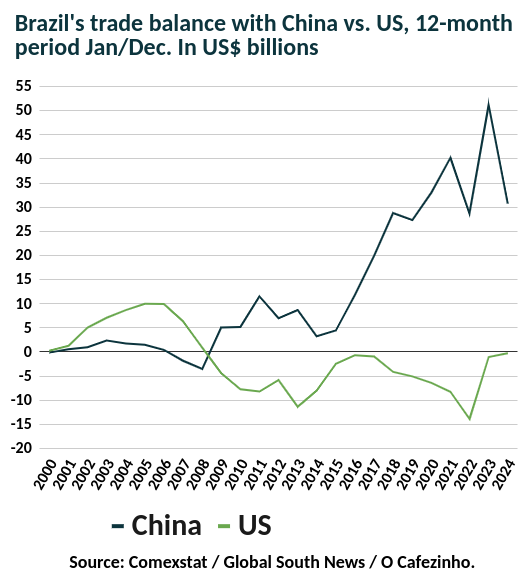

The data suggests Brazil should pay close attention to this Chinese strategy. China holds massive surplus capital that must be exported to sustain its growth, creating opportunities for emerging economies.

For Brazil, modernizing national infrastructure—especially freight and passenger transport—is urgent. This includes expanding metro systems, connecting states via high-speed rail, and slashing structural logistics costs.

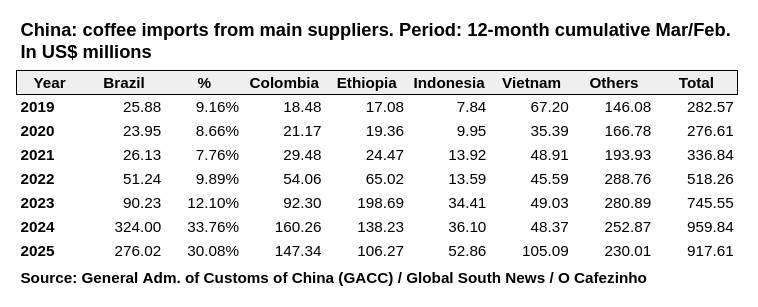

China is diversifying its consumption patterns, incorporating products like coffee, which could reshape global markets. Coffee, being labor-intensive, offers job-creation potential unlike mechanized commodities.

Per official Chinese government data, China imported $918 million worth of coffee over the 12 months ending February 2025—the second-highest value on record, trailing only the same period a year earlier.

Brazil supplied 30% of China’s coffee imports in those 12 months, followed by Colombia, Ethiopia, Indonesia, and Vietnam.

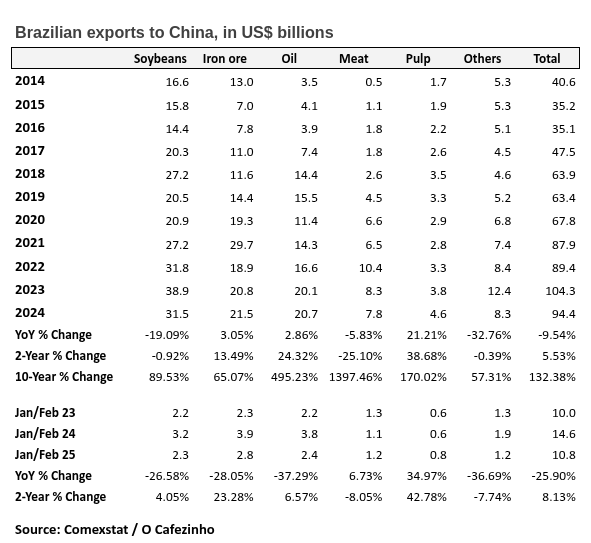

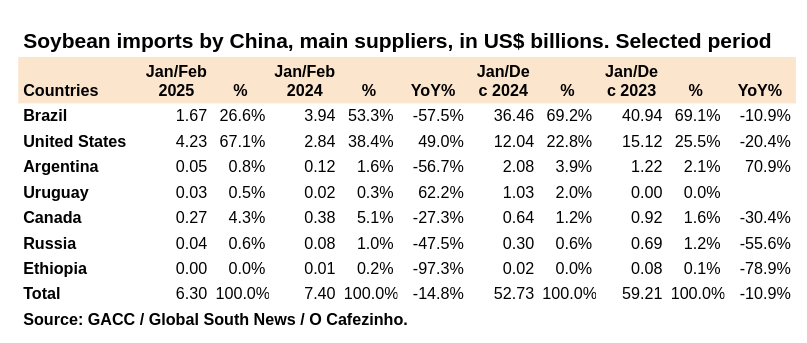

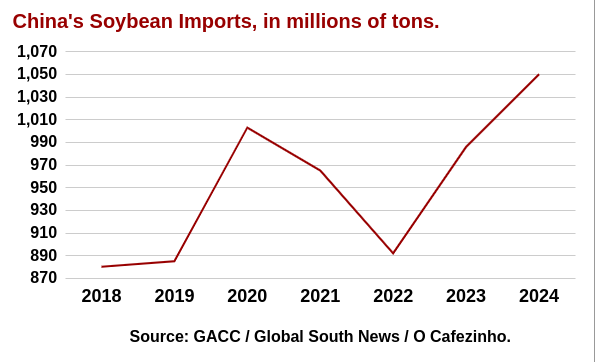

But soybeans remain Brazil’s top export to China. In 2024, Brazil shipped $36.5 billion in soybeans to China, accounting for a staggering 69% of all Chinese soybean imports. Total Chinese soybean imports for 2024 reached $52.73 billion.

In 2023, Brazil also held 69% of China’s soybean market. However, in the first two months of 2025, Brazil’s share plummeted to 27%, with a nearly 60% drop compared to the same period in 2024. The reasons likely include last year’s Brazilian crop failure and Chinese importers rushing to buy U.S. soybeans ahead of anticipated retaliatory tariffs.

With a bumper Brazilian harvest expected this year, the country will likely reclaim its position as China’s top soybean supplier.

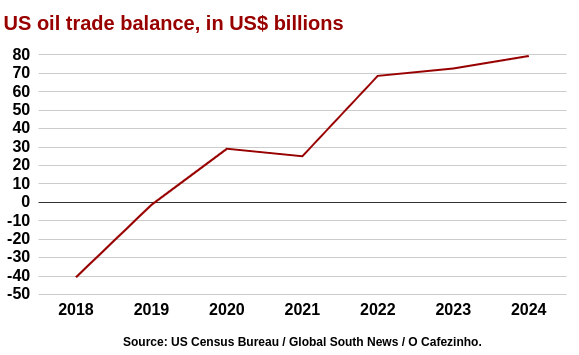

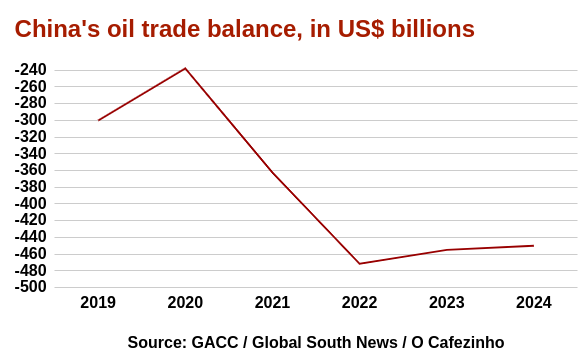

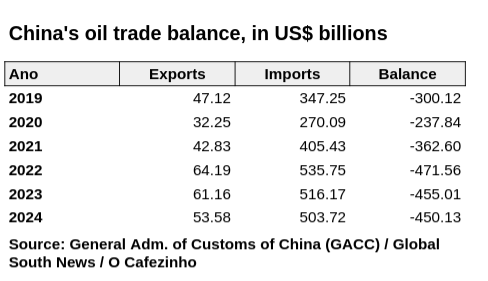

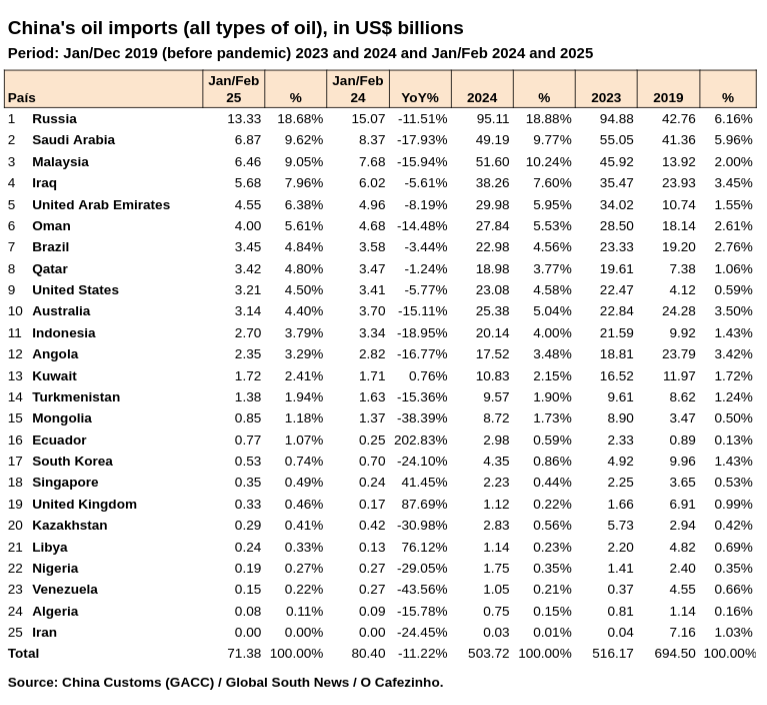

Finally, let’s discuss oil.

China runs an oil deficit. In 2024, it imported over $500 billion in oil, resulting in a $450 billion deficit. This explains why Chinese state oil giants are heavily investing in overseas exploration, including in Brazil.

The U.S., meanwhile, after years of deficits in the early 2000s, has rebounded to a massive surplus. In 2024, U.S. petroleum product exports hit $320 billion, with a $79 billion oil trade surplus—the largest in years, possibly ever.

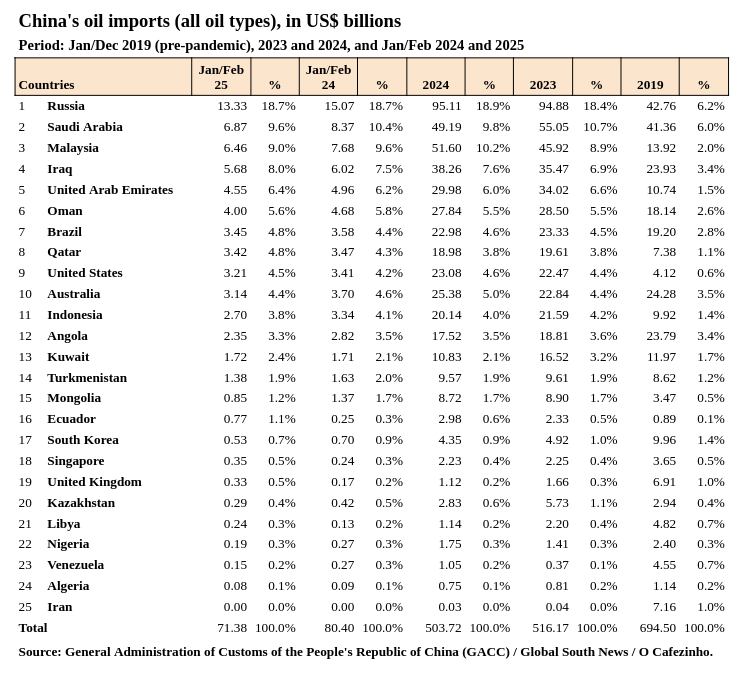

China’s oil deficit also underscores its growing reliance on Russia, its top supplier since the Ukraine war. In 2019, Russia supplied just 6% of China’s oil imports. By 2024, this jumped to 19%, holding steady into early 2025.

Other key oil suppliers to China in early 2025 (ranked by volume) include Saudi Arabia, Malaysia, Iraq, the UAE, Oman, and Brazil.

In 2024, Brazil accounted for 4.6% of China’s oil imports—identical to the U.S. share. But in early 2025, Brazil overtook the U.S., exporting $3.45 billion in oil versus America’s $3.21 billion.

Conclusion

To reiterate: China now holds the world’s largest pool of surplus capital for infrastructure investment, and Brazil has become one of its most strategic partners. Our economies are deeply integrated, as Brazil supplies the oil, iron ore, and protein essential to Chinese life. What do we lack? Infrastructure, particularly in transport—a sector where China shines as the global leader.

A cornerstone of China’s development has been rail transport: metro systems in megacities, modern freight railways, and high-speed networks connecting the nation. It’s time for Brazil to leverage this partnership to transform its own crumbling transport system.

Sources: China Customs, US Census Bureau, Comexstat (Brazil).