By Miguel do Rosario, editor

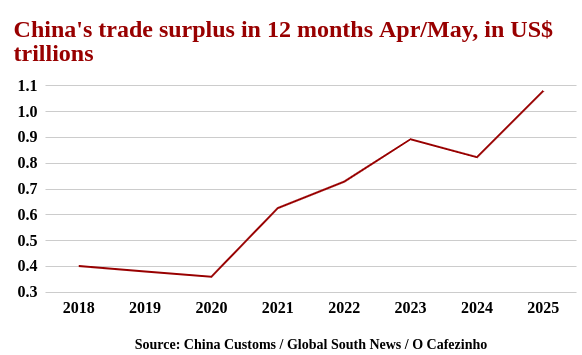

In 2024, China came close to hitting a $1 trillion trade surplus — but just missed the mark. Last year’s surplus stood at $992 billion. Some analysts said it was “close to a trillion,” but the truth is, China hadn’t crossed that line yet.

Now it has.

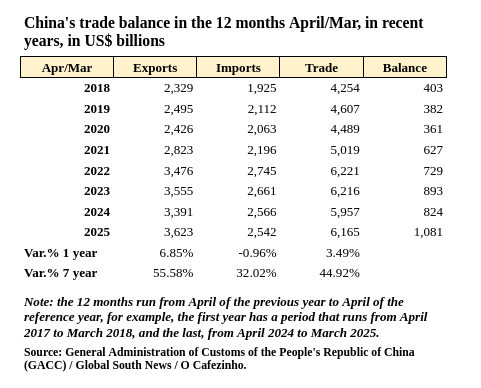

The figures come straight from the Chinese government — more precisely, from the General Administration of Customs of the People’s Republic of China (GACC). The 12-month compilation was put together exclusively by Cafezinho

According to official data, China exported $3.62 trillion worth of goods over the 12 months ending in March 2025, marking a nearly 7% increase from the previous period and a stunning 56% jump over the past seven years.

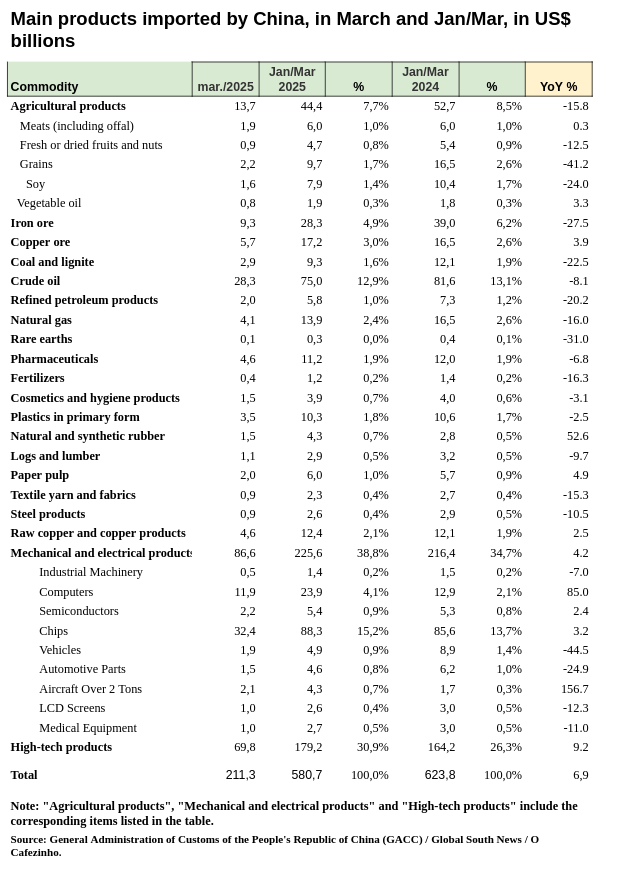

Imports during the same period totaled $2.54 trillion, remaining flat compared to the previous year.

That pushed China’s trade surplus over the past 12 months to a whopping $1.08 trillion — an all-time record.

The trade surplus is calculated as exports minus imports.

China’s total trade volume — the sum of exports and imports — reached $6.16 trillion over the 12 months through March.

Looking at the monthly and quarterly breakdowns, the numbers also hit historic highs.

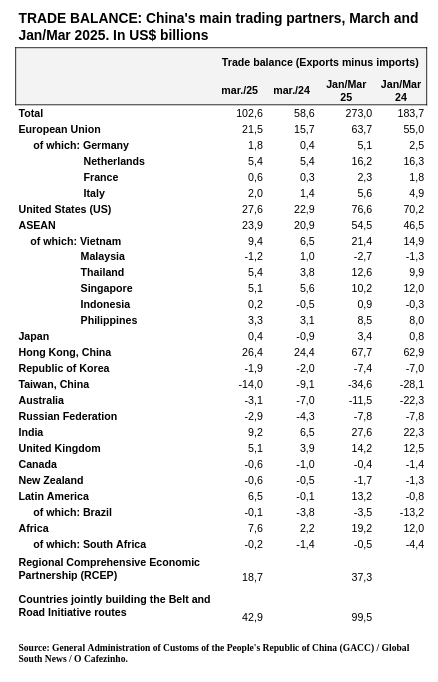

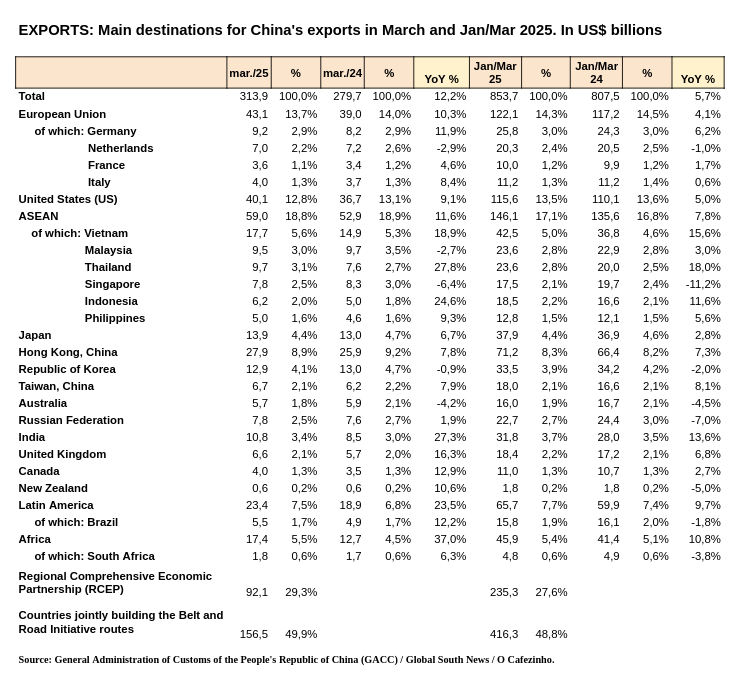

In March alone, Chinese exports totaled $313.9 billion, up 12% from March 2024. Imports for the month dropped 5% to $221.3 billion, giving China a staggering monthly surplus of $102.6 billion — another record, and 75% higher than the surplus posted in March 2024.

The first-quarter numbers tell a similar story of record-breaking trade.

We’ve put together a series of tables below to help you get a sense of how the world’s top industrial powerhouse is doing on the trade front.

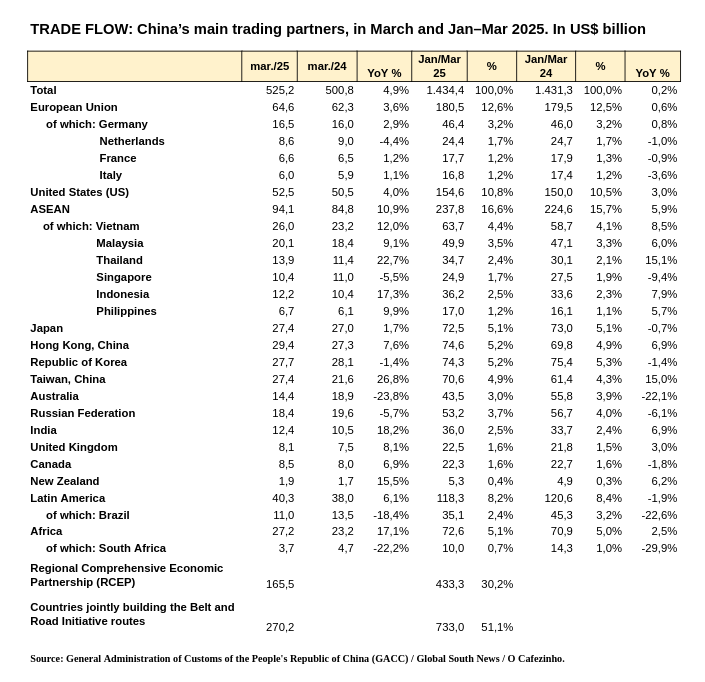

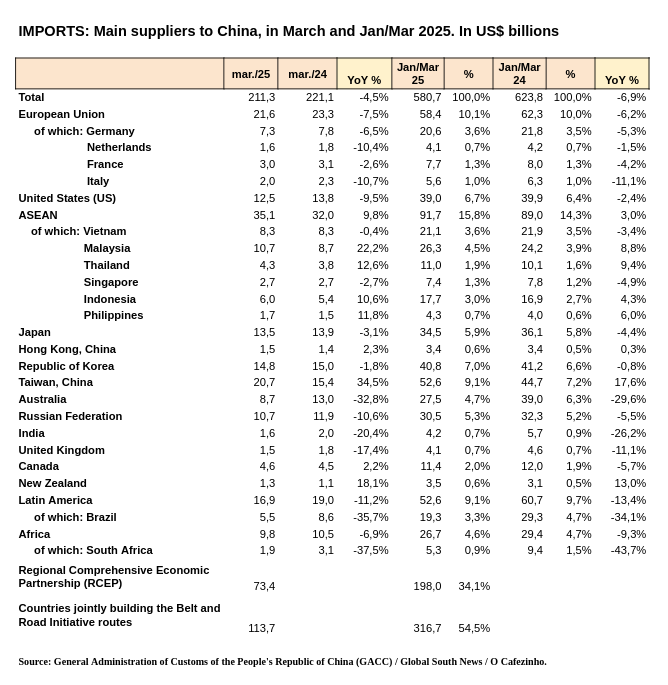

You’ll see, for instance, that the United States’ share of China’s total trade dropped to just 10% in March — the lowest level in decades — compared to 18% for ASEAN countries and 12% for the European Union.

China’s trade with Thailand, a key ASEAN member, grew 23% in March and 15% for the first quarter.

For the first time, China is also breaking out the countries involved in the Belt and Road Initiative in its trade data. Altogether, these countries accounted for 51% of China’s total trade volume in March and during the January–March period.

Meanwhile, Brazil is missing out on the action with China. In the first quarter, China slashed its imports from Brazil by a staggering 34%. As a result, Brazil’s share of China’s total imports plunged from 4.7% in Q1 2024 to just 3.3% in Q1 2025. In March alone, Chinese imports from Brazil tumbled 36%!

One big reason seems to be a sharp decline in Brazilian soybean exports to China. It’s a clear sign that Brazil’s failure to diversify its export lineup with China is a costly strategic mistake.

This slump flipped the Brazil-China trade balance — which had been heavily in Brazil’s favor — into negative territory both in March and for the full first quarter. However, this trend could reverse quickly starting in April as the new soybean crop comes to market. Plus, the ongoing US-China tariff war is creating fresh opportunities for Brazilian exporters.

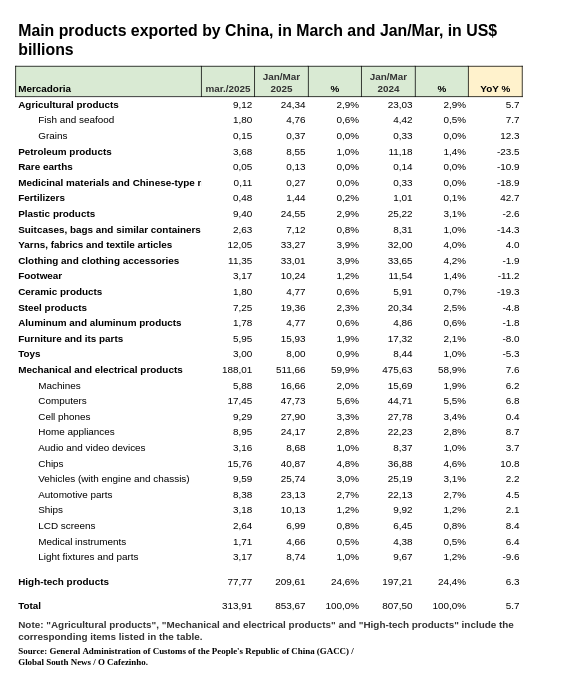

Among China’s top exports, technology products stood out. In the first quarter, China shipped $209 billion worth of high-tech goods, a 6% increase from a year ago — outpacing overall export growth.

China also remains a powerhouse in mechanical and electronic goods. In Q1, China exported $47.7 billion worth of computers (up 7% year-on-year) and $41 billion in chips (up 11%).

On the import side, China remains a major buyer of agricultural products (8% of its total imports) and oil (14%, including crude and refined). The country is also a significant importer of computers, chips, and aircraft.