Relations between Brazil and China continue to deepen extraordinarily. Brazilian exports to China in the first four months of 2025 (January-April) totaled US$28.5 billion, representing 26.5% of Brazil’s total exports during the period. If Taiwan were included, the total would reach US$29.0 billion, accounting for 27.0% of Brazilian exports. The main products exported by Brazil to China were soybeans (US$10.8 billion), crude oil (US$5.3 billion), iron ore (US$5.2 billion), and beef (US$1.9 billion).

These four products—soybeans, crude oil, iron ore, and beef—represented 37.5% of Brazil’s exports from January to April 2025, with China absorbing 57.7% of this total. These items are fundamental to Brazil’s trade surplus, according to data from ComexStat (Brazil’s trade statistics system) and China Customs.

This is not merely about trade, because these are not ordinary products, but absolutely critical commodities for the physical survival of the Chinese people. Two of these products are directly linked to the most decisive factor for human nutrition. Both beef and soybeans are the world’s richest food sources of protein.

The other two products—iron ore and crude oil—are, in turn, equally strategic inputs. Oil remains the world’s primary energy source. Iron ore is the main component for construction, essential for steel production. Without iron ore, there is no steel; without steel, there are no railways, ports, or construction in China.

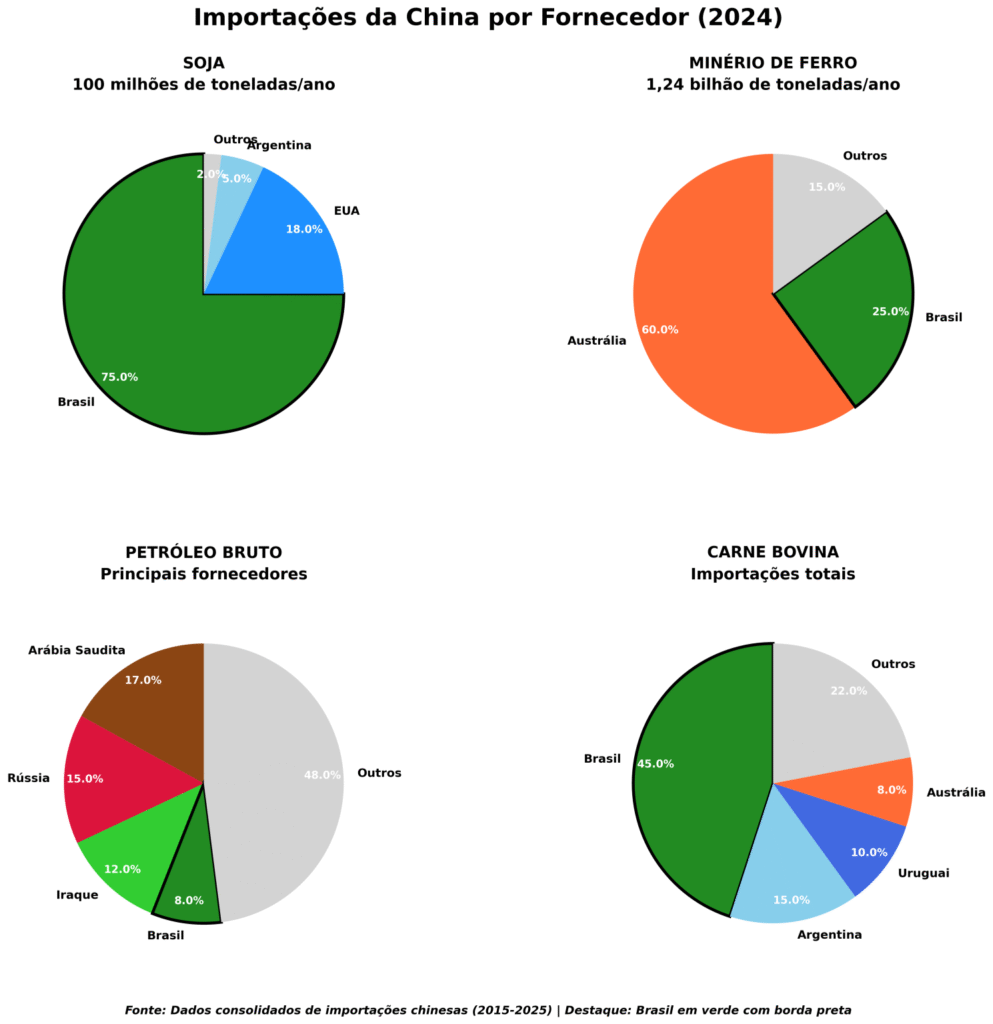

Brazilian producers play a crucial role in China’s food security. In soybeans, Brazil’s dominance is absolute: 75% of the 100 million tons annually imported by China come from Brazil, followed by the U.S. (18%) and Argentina (5%). In January-April 2025, China bought 74.1% of all soybeans exported by Brazil. This soybean supply sustains the entire animal production chain of the Asian giant, as 70% of imported volume becomes feed for livestock that produce meat, milk, and eggs consumed by 1.4 billion people.

Simultaneously, Brazil leads beef exports to China, holding 45% of the market, surpassing Argentina (15%), Uruguay (10%), and Australia. Brazilian beef accounts for 12.1% of Chinese consumption. In January-April 2025, China purchased 54.0% of all beef exported by Brazil.

Brazilian iron ore similarly fuels China’s urban and industrial expansion, representing 25% of its imports, while Australia dominates with 60%. Brazilian ore supplies 8.7% of China’s total consumption and meets 20–25% of its imports. In Q1 2025, China absorbed 65.0% of Brazil’s iron ore exports.

In energy, Brazilian crude oil accounts for 8% of China’s imports, in a market led by Saudi Arabia (17%), Russia (15%), and Iraq (12%). In January-April 2025, China bought 37.4% of Brazil’s exported oil, totaling US$5.3 billion. This share diversifies China’s energy matrix and reduces geopolitical vulnerabilities.

China imports 85% of its consumed soybeans, 68% of its oil, 54% of its iron ore, and 26% of its beef.

Among all agricultural commodities, soybeans stand out for unique nutritional traits. They contain 40% protein, far surpassing corn (8–10%), wheat (12–14%), and other legumes like beans (20–25%). Soybeans also provide complete protein, containing all eight amino acids essential for animal and human nutrition.

Brazilian soybean production focuses on grains. China processes this material to extract oil and produce meal, which constitutes two-thirds of global protein ingredients for animal feed.

Soybean’s historical trajectory spans five millennia. Farmers in the Yellow River Valley first domesticated this plant, which remained confined to the Far East for millennia. Its expansion to Europe occurred in the 18th century, reaching the Americas only in the 20th century.

The nutritional revolution of the last century definitively transformed global livestock farming. Researchers discovered that combining soybeans with cereals creates highly efficient feed, enabling significant increases in meat and egg production. This discovery revolutionized animal production systems worldwide.

Environmental limitations intensify China’s need for reliable partners. The country intensely exploits its arable land and faces growing soil degradation, water scarcity, and air pollution.

On Brazil’s side, prospects are favorable for expanding protein supply. The MATOPIBA region (Maranhão, Tocantins, Piauí, Bahia) adds millions of productive hectares. Tropical agricultural technology enhances competitive advantages for national agribusiness. Brazil’s high-quality iron ore reserves guarantee supply for decades. The pré-sal oil fields offer stable energy for Chinese cities and industries while generating trade surplus.

This convergence between China’s needs and Brazil’s capabilities creates an alliance deepening amid rising global geopolitical tensions. While Western powers intensify pressure on China and force alignments, Brazil provides natural resources, agricultural technology, and institutional stability. China reciprocates with market access, investments, and industrial technology.

Brazil should leverage this position to attract Chinese infrastructure investments. The deepening strategic relationship creates opportunities for transformative projects. The bioceanic railway—connecting the Atlantic to the Pacific via Brazil and Peru, accessing Chancay Port—is only the beginning. The country could attract investments in high-speed rail, metro systems, and LRTs to revolutionize urban mobility.

Another product scaling rapidly in exports to China—which may soon become a top export—is coffee. Chinese consumers are maturing their coffee habits, opening promising prospects for this Brazilian commodity.

As Confucius observed: “Is it not a joy to have friends coming from afar?” In this partnership, friendship has transformed into a geopolitical blood pact, based on shared vital needs and a common vision for the future.