By Manus AI

Food inflation in Brazil is showing consistent signs of cooling down, as revealed by the latest data from the Getulio Vargas Foundation’s (FGV) General Price Index – Domestic Supply (IGP-DI). This downward movement, which intensified in June 2025, is primarily driven by the Broad Producer Price Index (IPA-DI), a component that represents over 60% of the IGP-DI and serves as an early indicator of inflationary trends that later reflect in retail prices.

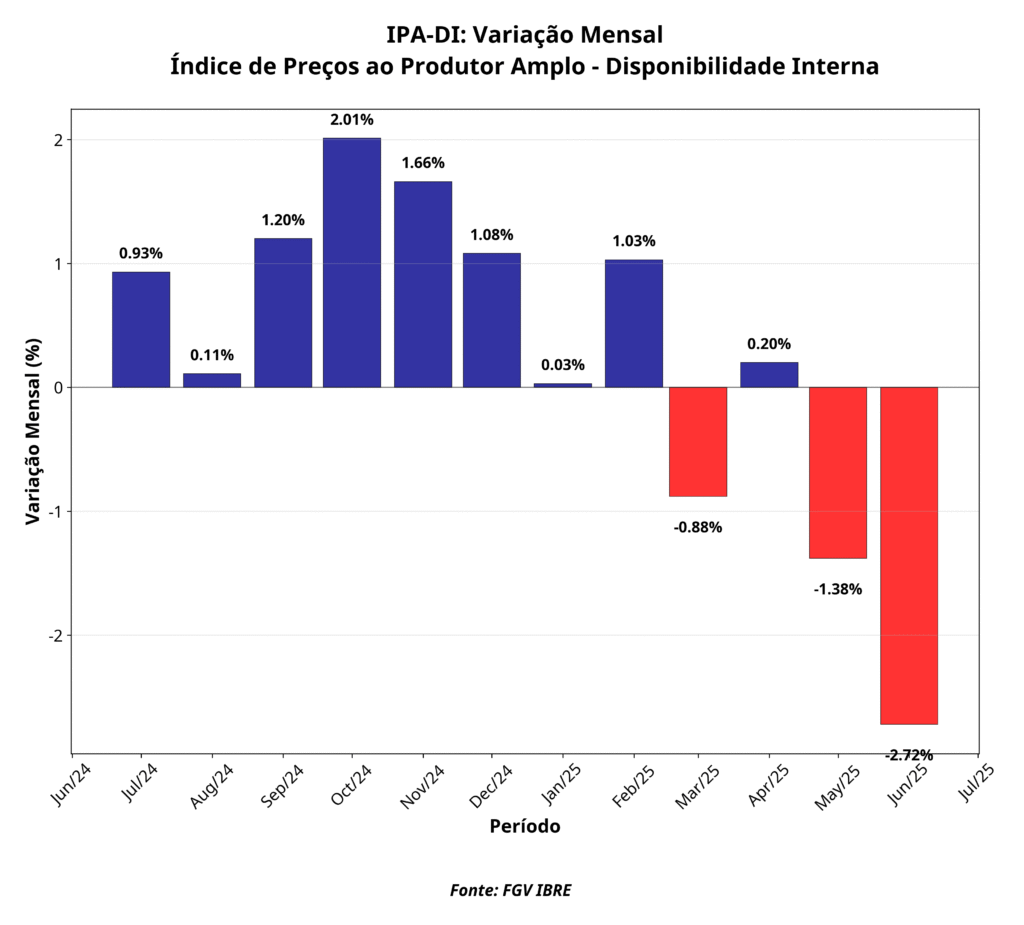

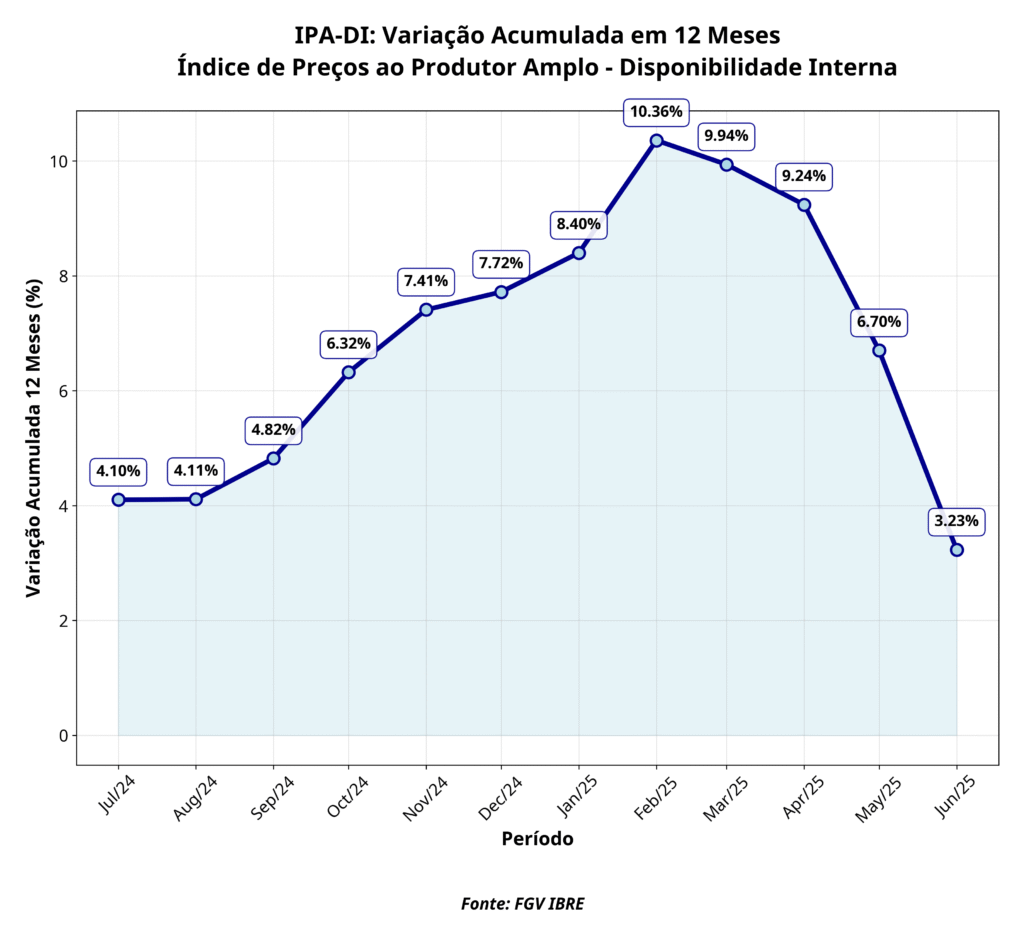

The June figures brought significant relief to a country whose collective memory bears the scars of hyperinflation. The IPA-DI registered a 2.72% drop in the month, deepening the downward trajectory that began in May, when it had retreated 1.38%. On an annualized basis, the index accumulated an increase of just 3.23% over 12 months, a level not seen for years, signaling a structural shift in wholesale price behavior.

The Weight of the IPA-DI in the Brazilian Economy

The Broad Producer Price Index – Domestic Supply is not just another economic indicator. With a 60% share in the IGP-DI’s composition, it represents the most sensitive barometer of inflationary pressures originating in the productive and wholesale sectors. Its importance transcends mere numbers: it acts as an early warning radar for trends that, months later, reach supermarket shelves and the pockets of final consumers.

The relevance of the IPA-DI lies in its ability to capture price variations at different stages of the production chain. From raw materials to final goods destined for consumption, the index offers a complete radiography of wholesale price movements. When the IPA-DI shows consistent declines, as observed in recent months, it indicates that inflationary pressures are dissipating at the source, creating favorable conditions for price stability in retail.

The monthly trajectory of the IPA-DI in 2025 reveals a change in direction that became more evident starting in March. After registering a 1.03% increase in February, the index began a corrective movement that intensified in the following months. The 2.72% drop in June represents the largest monthly decline since the beginning of the year, consolidating a trend that had already manifested in May with a 1.38% retraction.

The behavior of the IPA-DI on an annualized basis offers an even more revealing perspective. The index, which accumulated a high of 10.36% over 12 months during February, showed consistent deceleration in subsequent months. The drop to 3.23% in June represents a reduction of more than 7 percentage points in just four months, signaling a structural shift in wholesale price behavior.

The Anatomy of the Drop: Raw Materials Lead the Movement

The breakdown of the IPA-DI by processing stages reveals that the downward movement originates in raw materials, a segment that registered a 4.95% retraction in June. This behavior is particularly significant because raw materials function as the first link in the production chain, and their variations tend to propagate to other stages in the following months.

Matheus Dias, an economist at FGV IBRE, highlights that “raw materials explain the drop in the IPA’s rate of variation, the index with the greatest weight in the IGP-DI.” Among the products that contributed most to this dynamic, coffee stands out with significant drops in producer prices. This reduction is already beginning to reflect in retail prices, initially with a more pronounced slowdown in product inflation.

Iron ore, a basic input in steel production, also showed significant declines. According to Dias, these reductions “have led to smaller pass-throughs in metallic materials for structures in the INCC,” demonstrating how deflation in raw materials propagates through the production chain.

Early Signs: From Wholesale to Retail

The importance of the IPA-DI as an early indicator becomes evident when observing its relationship with other price indices. While the IPA-DI already shows consistent declines, the Consumer Price Index (IPC), which comprises 30% of the IGP-DI, still registers positive variations, though decelerating. In June, the IPC advanced 0.16%, a significant reduction compared to 0.34% in May.

This time lag is natural and expected. Wholesale prices, captured by the IPA-DI, tend to reflect in retail with a few months’ delay. The current downward trajectory of the IPA-DI suggests that consumers should start feeling the effects of food deflation in the coming months, especially in basic products like coffee, vegetable oils, and proteins.

The analysis by expenditure classes of the IPC already offers clues about this transition. The Food group, which had registered a 0.29% increase in May, showed a 0.19% drop in June, signaling that the deflation observed in wholesale is beginning to reach supermarket shelves.

The Context of Global Commodities

The fall in food prices in Brazil does not occur in a vacuum. The movement largely reflects the global dynamics of commodities, which are undergoing a correction period after the peaks observed in previous years. According to World Bank projections, global commodity prices are expected to fall by 12% in 2025, reaching levels not seen since 2020.

This global trend echoes in the Brazilian economy through different channels. Coffee, a commodity in which Brazil is a world leader, has its international prices influenced by factors such as climate conditions, global stocks, and international demand. The current drop in producer prices partly reflects a normalization after periods of high volatility.

The Psychological Dimension of Inflation in Brazil

To fully understand the meaning of the current drop in food inflation, it’s necessary to consider the psychological dimension that inflation occupies in Brazilian society. The country carries in its collective memory the deep scars of the hyperinflation that marked the 1980s and 1990s, a period when prices sometimes changed daily and the currency lost its basic function as a store of value.

This historical trauma created a particular sensitivity among Brazilians regarding inflation. Unlike other countries where price stability is seen as natural, in Brazil, inflation remains a constant concern, influencing everything from consumption decisions to political evaluations. The memory of hyperinflation, when the IGP-DI registered monthly variations exceeding 80%, still echoes in the collective psychology.

This sensitivity is reflected in the importance that price indicators assume in the Brazilian public debate. Variations that would go unnoticed in other countries gain prominence in the media and influence the perception of governments’ economic competence. Inflation, more than an economic phenomenon, has become a political barometer, capable of influencing governmental evaluations and electoral expectations.

Political and Economic Implications

The current downward trajectory of food inflation occurs in a particular political context. Sources close to the Central Bank indicate that the institution’s president, Gabriel Galípolo, is committed to consolidating price stability as a way to contribute to the country’s economic stability. This stance reflects the understanding that inflation control transcends technical issues, taking on political and social dimensions.

The drop in food inflation has the potential to generate positive effects in multiple dimensions. From an economic perspective, the reduction in inflationary pressures can create space for more flexible monetary policies, favoring economic growth. From a social perspective, food price stability directly benefits lower-income families, who allocate a larger portion of their income to food.

Future Perspectives and Challenges

Although recent data are encouraging, the consolidation of the deflationary trend faces important challenges. The international scenario remains volatile, with geopolitical risks that could affect commodity prices. Changes in climate conditions, alterations in global demand, or trade tensions could quickly reverse the current downward price trend.

Domestically, the sustainability of food deflation depends on maintaining consistent economic policies. Exchange rate stability, fiscal control, and coordination between monetary and fiscal policies are fundamental elements for the current trend to consolidate.

Conclusion: A New Chapter in Brazil’s Inflationary History

The fall in food inflation, led by the behavior of the IPA-DI, represents more than a simple statistical correction. It symbolizes the possibility of a new chapter in Brazil’s relationship with price stability, gradually overcoming the traumas of the past and building a solid foundation for sustainable economic growth.

The June 2025 data offer reasons for cautious optimism. The 2.72% drop in the IPA-DI, the reduction of the annualized index to 3.23%, and the signs that this deflation is beginning to reach retail suggest that the country may be entering a period of greater price stability.

For a society that carries the scars of hyperinflation in its memory, each month of deflation represents not only economic relief but also a step towards a normalcy that for a long time seemed unattainable. The fall in food inflation, according to FGV data, may be signaling that this normalcy is finally within reach.