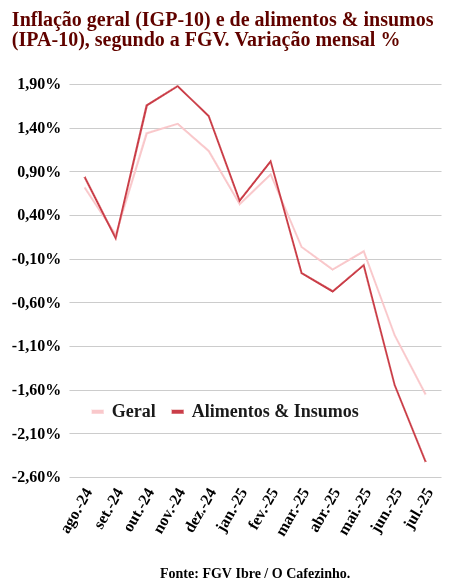

Food prices continue to fall, according to the latest inflation indicators from the Getúlio Vargas Foundation (FGV) released today. The IGP-10 (General Price Index – 10) registered a drop well beyond market expectations, falling 1.65% in July.

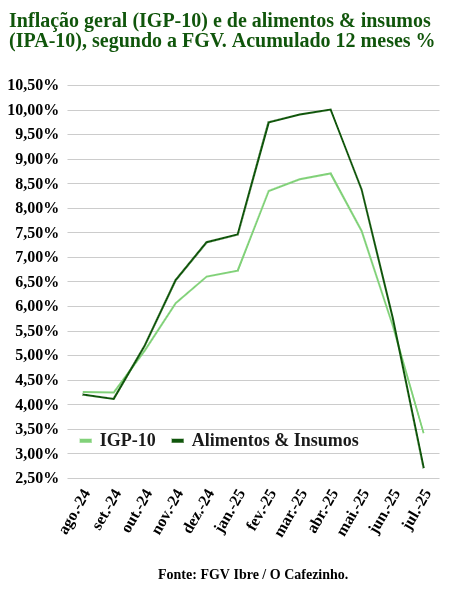

The good news is that the IPA (Broad Producer Price Index), which mainly includes the price of food and manufactured consumer goods, fell even more sharply this month, registering a drop of 2.42%. When we analyze the accumulated 12-month period, both the general price index (IGP-10) and the price paid to the producer also show a very significant decrease. The IGP-10 has accumulated a 3.42% increase over the last 12 months, whereas in July 2024 it showed an accumulated 12-month increase of 3.38%, indicating a significant slowdown.

This indicator of the price paid to the producer is not yet directly reflected on supermarket shelves and may take a few weeks to reach the final consumer. But it will certainly arrive.

Highlight on Coffee

Among the products that contributed most to this decline, green coffee stood out with a reduction of -19.54% in the month, being one of the main drivers of the deflationary dynamic of the IGP-10. Other agricultural products also registered significant drops:

- Corn kernels: -11.38%

- VHP Sugar: -10.49%

- Iron ore: -6.83%

- Soybean meal: -6.47%

CPI Registers Deceleration

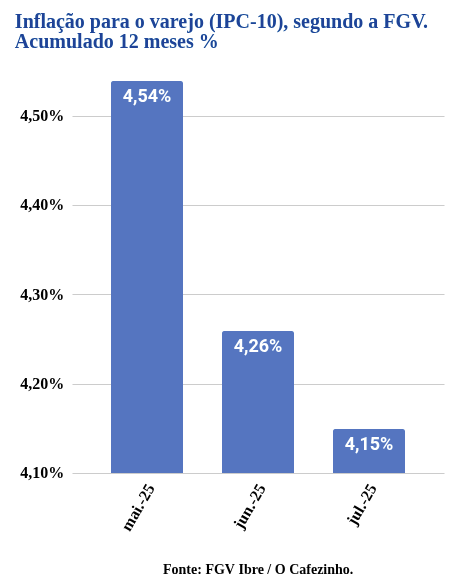

The FGV’s CPI (Consumer Price Index), which tracks retail prices, registered a rate of 0.13% in July, showing a deceleration compared to the previous month, when the index rose 0.28%. This index is fundamental for understanding how price variations reach the final consumer.

The IPC-10 has accumulated a 4.15% increase over the last 12 months, demonstrating a trend of easing inflationary pressures in retail compared to the peaks observed in previous months. In the CPI, products such as ‘laranja-pera’ oranges (-12.39%), English potatoes (-6.93%), and gasoline (-0.62%) showed significant declines, demonstrating that deflation is already reaching retail prices.

Comparison with IPCA

FGV’s data corroborates the trend already observed in the latest IPCA figures released by IBGE. The IPCA registered 0.24% in June, showing that inflation, especially food inflation, is decelerating. The Food and Beverages group of the IPCA registered its first decline (-0.18%) in 9 months.

In the IPCA, products such as chicken eggs (-6.58%), rice (-3.23%), and fruits (-2.22%) also showed significant declines, confirming the deflationary trend observed in FGV’s indicators. The INPC (National Consumer Price Index) rose 0.23% in June, accumulating 3.08% for the year and 5.18% over the last 12 months, below the 5.20% observed in the immediately preceding 12 months.

Impact of American Tariffs

Furthermore, the tariff dispute with the United States and the tariffs Americans are threatening to impose on Brazil could result in an even sharper drop in the prices of meat and coffee, which are currently the only food products that haven’t seen their prices fall significantly. This situation could further alleviate the budget of Brazilian families, as these products, which traditionally weigh heavily on consumer pockets, could have their prices reduced if the domestic market absorbs the production that would have been destined for export to the United States.

Impacts on Monetary Policy

All of this creates a favorable environment for the Central Bank to stop raising interest rates and signal a possible reduction in the country’s benchmark interest rates, considering the scenario of easing inflationary pressures, especially in the food sector.

What is IGP-10?

The General Price Index – 10 (IGP-10) is an important economic indicator calculated by the Getúlio Vargas Foundation that measures price variations in the Brazilian economy. Along with the IPCA and the INPC, the IGP-10 is one of the main references for monitoring the evolution of inflation in the country. The index is composed of three main components:

- IPA (Broad Producer Price Index): measures wholesale price variations.

- IPC (Consumer Price Index): tracks retail prices.

- INCC (National Construction Cost Index): monitors costs in the civil construction sector.

The importance of the IGP-10 lies in its ability to capture price movements at different stages of the production chain, offering a comprehensive view of inflationary pressures in the Brazilian economy.