WASHINGTON, DC - APRIL 02: U.S. President Donald Trump holds up a chart while speaking during a “Make America Wealthy Again” trade announcement event in the Rose Garden at the White House on April 2, 2025 in Washington, DC. Touting the event as “Liberation Day”, Trump is expected to announce additional tariffs targeting goods imported to the U.S. (Photo by Chip Somodevilla/Getty Images)

In his classic work “Anti-Dühring” from 1878, Friedrich Engels observed: “How can one say, therefore, to use an expression that provokes so much indignation in Mr. Dühring, that quantity is transformed into quality and vice versa.” This maxim could perhaps also be applied to Brazilian foreign trade in recent years.

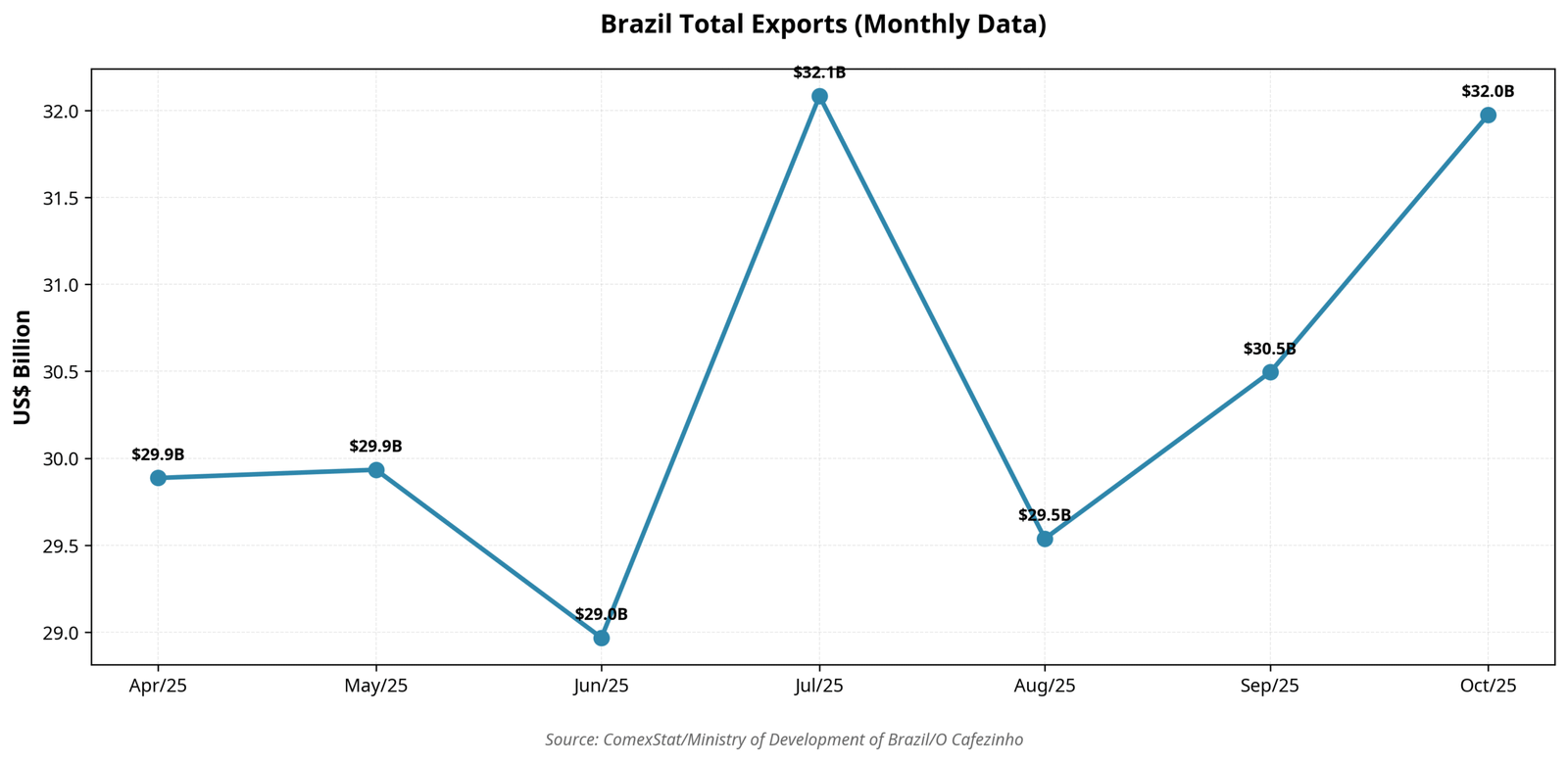

The magnitude of the numbers suggests a profound qualitative transformation in the country’s economy and its strategic role in the global value chain, in the financial stability of international markets, and in the food security of a significant part of humanity. October’s exports, which reached US$32 billion and matched the historical record set in July, confirm this structural change in Brazil’s commercial geography. The data comes from ComexStat, the statistical agency of the Ministry of Development, Industry, Commerce and Services.

A key aspect of this transformation is the dramatic shift in Brazil’s trade partnerships. The United States’ share in Brazilian foreign sales fell to just 6.9% in October, a stark contrast to the roughly 25% it represented two decades ago. The recent decline was accentuated by the effects of new tariffs imposed by Washington, which began in April and were intensified in August, when the rate was raised to 50% for more than a third of Brazilian products.

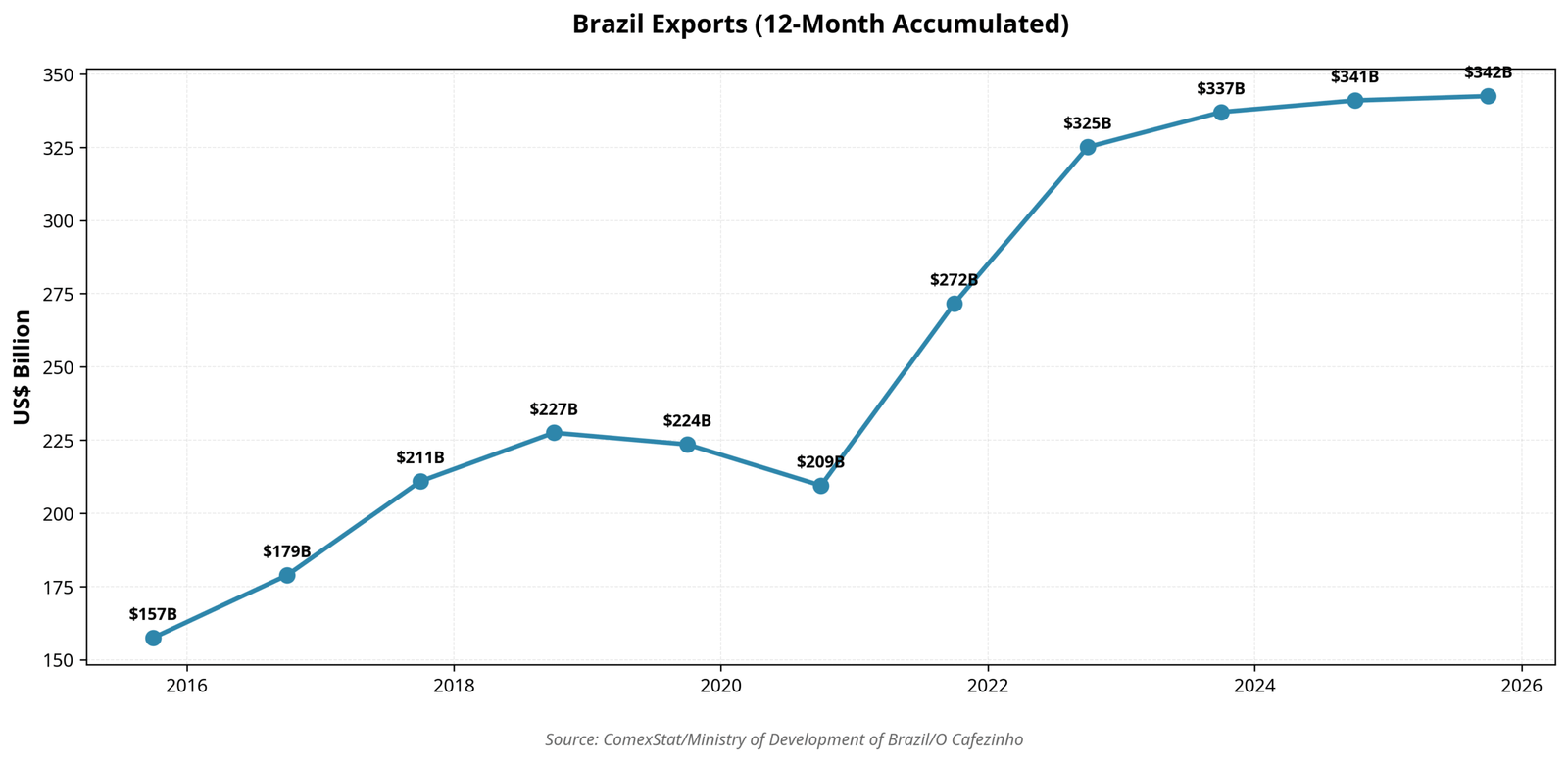

Even with this sharp drop in sales to the United States, Brazil’s total exports in October grew by a robust 9.13% compared to the same month of the previous year, driven by successful diversification into other markets and a broader export portfolio. Through a combination of hard work, strategic diplomacy, and the famous national jeitinho, Brazil effectively navigated and defeated the tariff barriers.

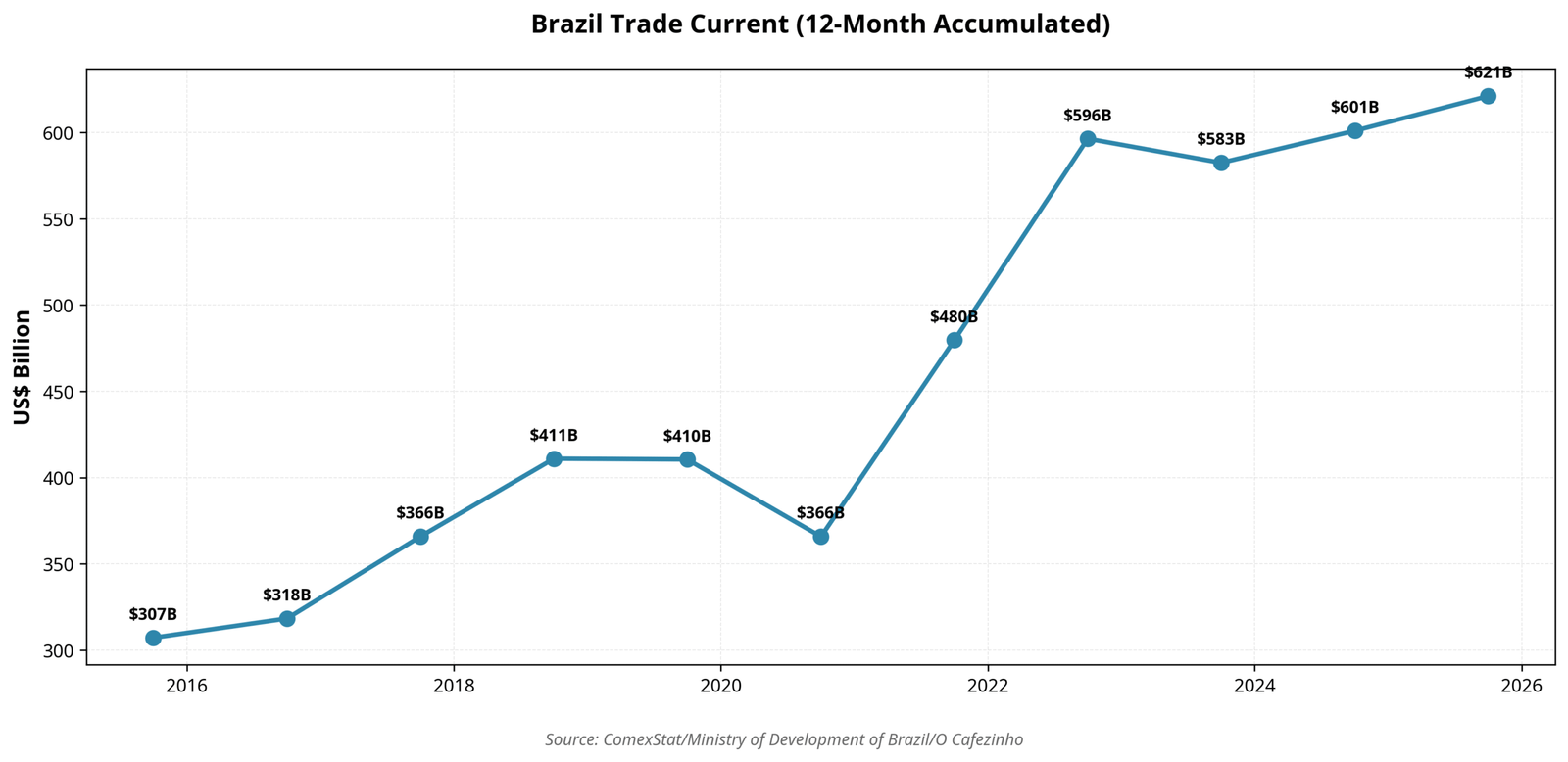

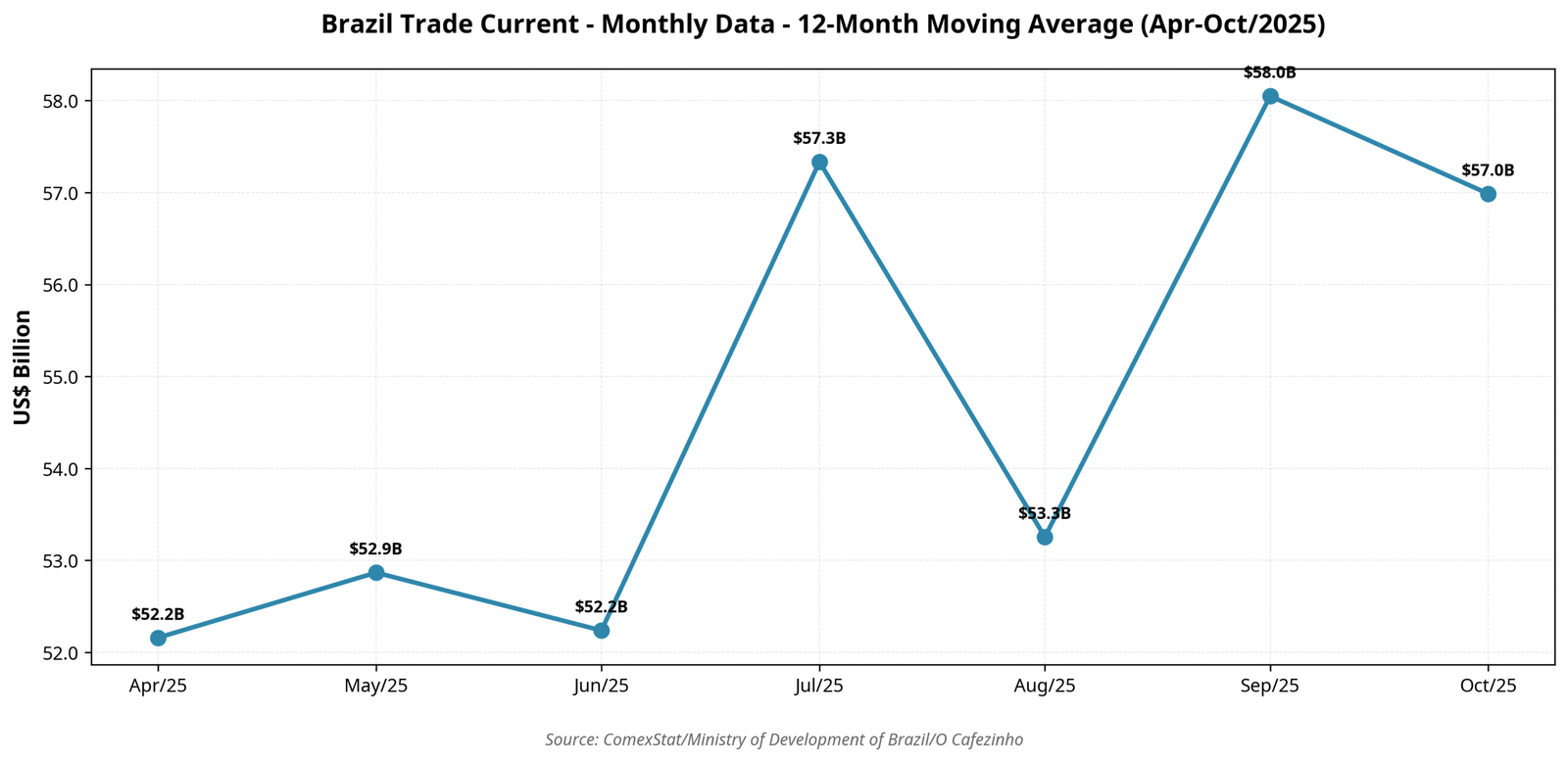

The positive momentum is reflected across multiple indicators. October’s trade surplus reached US$7.0 billion, the second-highest figure for the month in history and representing a remarkable 70.7% increase compared to October 2024. On a broader scale, the 12-month accumulated trade flow hit a historic peak of US$645.3 billion, equivalent to R$3.3 trillion. To put this in perspective, this figure would correspond to the entire federal government’s expenditure over 12 months plus nominal interest payments.

This strong performance is further highlighted by the 12-month accumulated exports, which set a new record of US$342.5 billion in the period ending in October 2025, growing 3.1% year-over-year and significantly bolstering the trade surplus. The 12-month moving average for the trade current rose 2.3% between April and October 2025, while the same indicator for exports grew by 2.0%, reflecting the steady heating of Brazilian foreign trade.

China has solidified its position as Brazil’s main trading partner, absorbing about a third of all Brazilian exports, followed by the European Union and, in third place, South American countries. Trade with the United States, although still relevant, has been losing ground both in absolute value and in relative share.

What was once labeled the ‘primary sector’ today represents one of the world’s most sophisticated productive complexes. For Brazil to supply a large portion of the plant and animal protein consumed on the planet, massive investments in technology, science, and genetics are necessary, supported by a highly complex logistical, commercial, financial, and diplomatic structure. The soy or meat chain, for example, involves everything from satellites and drones in the field to route optimization algorithms in ports, consolidating the country as an agro-technological powerhouse.

The engine of this export boom includes agribusiness, mining, and a growing manufacturing industry. Oil and its derivatives lead the export list, accounting for 16.16% of the total, followed by soybeans at 14.16% and iron ore at 10.97%. In the industrial sector, vehicles, machinery, electric generators, and chemical products stand out, conquering new markets outside the traditional axis. The industrial portfolio now accounts for about 28% of exports, representing a significant advance compared to previous years.

Among the products with the highest growth in 2025 are non-monetary gold, which surged 67.46%, vehicles with a 35.91% increase, coffee growing 32.75%, and meats expanding 19.69%. These figures demonstrate the breadth and dynamism of Brazil’s export capacity.

The United States, despite its declining share, continues to be the main destination for Brazilian manufactured products, especially automobiles, engines, airplanes, and machinery. Asian countries, particularly China, are increasing their demand for primary and intermediate goods, which has stimulated significant logistical and diplomatic investments in integration with the Asian continent.

In terms of foreign trade dependency, Brazil maintains a moderate profile. Exports of goods and services represent about 17% of GDP, an intermediate level between China at 20% and the United States at 11%, but very far from highly open economies like Germany at 48% and Vietnam at 85%. Considering the entire trade flow, which includes both exports and imports of goods and services, the share in Brazilian GDP is 34%, well below the world average of 58%. Again, Brazil is positioned between China at 37% and the United States at 40%, but very far from Germany at 90% and Vietnam at 185%.

This sustained growth, coupled with strategic market diversification and the increasing sophistication of its productive sectors, places Brazil in a formidable position on the global economic stage, demonstrating that the quantitative expansion of recent years has indeed generated a qualitative transformation in the country’s role in international trade.