November 23, 2025 – Official photo of the IBSA Summit. President of the Republic Luiz Inácio Lula da Silva during the official photo of the IBSA Summit, a trilateral forum for dialogue and cooperation between India, Brazil, and South Africa. In the photo: the President of South Africa, Cyril Ramaphosa, and the Prime Minister of India, Narendra Modi. Johannesburg / South Africa. Photo: Ricardo Stuckert / PR

2025 was an extraordinary year for Brazilian foreign trade.

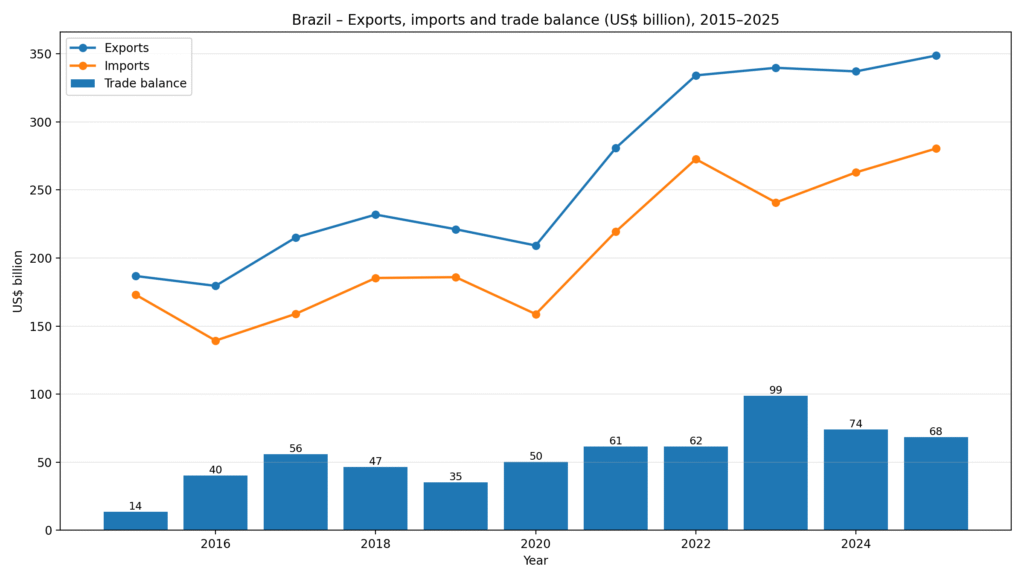

Even in the face of disgraceful attacks from the White House, which tried to intimidate Brazil with a 50% tariff hike on its products and was later forced to retreat on most of them, Brazilian exports reached an all-time record, totaling US$ 348.68 billion.

This figure represents a 3.5% increase over 2024. But it is only when we take a longer historical view that the true scale of this expansion becomes clear, as well as Brazil’s growing share in the global economy.

The sheer magnitude reached by Brazilian exports, in value terms, compels us to rethink some long-held assumptions about the country’s role in the international division of labor.

The long-standing and often fair criticism that Brazil occupies a subordinate position by exporting primary goods and low value-added products may still persist, but it now requires nuance. It is no longer accurate to speak of low value added when quantity, as Marx once observed, is being transformed into quality.

Exceptionally high productivity levels in sectors traditionally seen as “primary” have expanded Brazil’s share in international markets across a wide range of products.

Unlike the past, when Brazil exported raw materials with very low real returns and frequently suffered from monoculture and a narrow concentration of export destinations, today the picture is reversed. Brazil sells an extensive array of products to a broad and diversified set of countries, the result of a joint effort between the professional diplomacy of Itamaraty and the political diplomacy of President Lula.

The expansion of global demand, driven by billions of people entering consumer markets, has helped stabilize prices for most of the commodities Brazil exports. Intensive use of technology and sophisticated logistics is allowing Brazil to earn an impressive inflow of dollars.

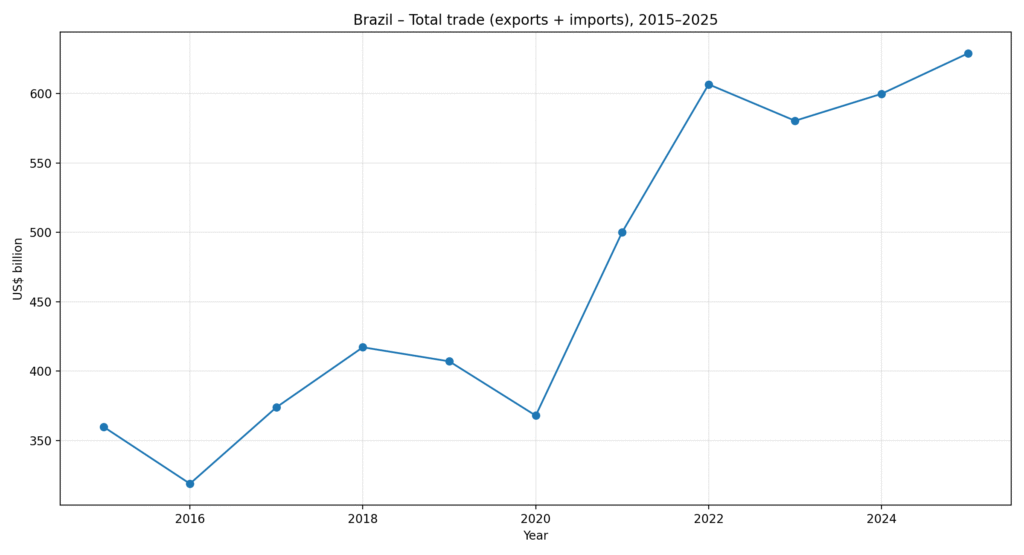

Brazil’s total trade flow — the sum of exports and imports — reached US$ 629.06 billion in 2025. Over the last decade (2016–2025), total trade amounted to US$ 4.80 trillion, an increase of 27.0% compared to the previous decade (2006–2015). By comparison, in the first decade of the 2000s (2001–2010), total trade stood at just US$ 2.24 trillion.

This expansion in trade flows has been driven primarily by exports. Brazil’s trade balance recorded a surplus of US$ 68.29 billion in 2025, the third-largest surplus in the country’s history, surpassed only by 2023 (US$ 98.90 billion) and 2024 (US$ 74.18 billion). The surplus would have been even larger if imports had not also grown, reaching US$ 280.38 billion — a positive development insofar as it helps modernize the economy through the acquisition of machinery and electronics.

China remains Brazil’s largest trading partner, with a total trade flow of US$ 170.95 billion in 2025. What is striking, however, is that the recent surge in Brazil’s exports and overall trade has been driven less by China itself and more by other markets, highlighting the country’s increasing diversification of trade partners. Brazil expanded both exports and total trade even as exports to the United States declined and trade with China lost relative weight.

India stood out in particular in 2025. With a population that has now surpassed China’s, India recorded a total trade flow of US$ 15.21 billion with Brazil, an increase of 25.5% over 2024. Brazil exported US$ 6.86 billion to India and imported US$ 8.35 billion, resulting in a trade deficit of US$ 1.49 billion.

Africa represents another highly promising market. With a population of 1.5 billion and countries such as Nigeria poised to become some of the world’s largest economies in the coming decades, the African continent constitutes a major frontier for Brazilian trade expansion. In 2025, Brazil’s total trade with Africa reached US$ 23.70 billion, with exports of US$ 15.48 billion, imports of US$ 8.22 billion, and a trade surplus of US$ 7.26 billion. Brazilian exports to Africa have grown by 159% over the past 20 years.

Oil has become one of the pillars of Brazilian foreign trade. Total oil trade (crude and refined) reached US$ 77.28 billion in 2025, accounting for 12.3% of Brazil’s total trade flow.

Brazil exported US$ 55.11 billion in oil in 2025, an increase of 691.7% over the past 20 years. In 2005, oil exports totaled just US$ 6.96 billion. On the import side, Brazil purchased US$ 22.16 billion in oil in 2025, resulting in a trade surplus of US$ 32.95 billion.

Crude oil alone accounted for US$ 44.67 billion in exports, generating a surplus of US$ 38.06 billion in 2025. Exports of refined petroleum products reached US$ 10.44 billion, but Brazil still imports US$ 15.55 billion in derivatives, producing a deficit of US$ 5.11 billion in this segment.

What is particularly noteworthy is Brazil’s ability to identify profitable niches within specific refined products, such as fuel oil, widely used as marine fuel for cargo ships, oil tankers, and bulk carriers on long-haul ocean routes.

Soybeans remain Brazil’s single largest export product, totaling US$ 43.54 billion in 2025 — a 1.4% increase over 2024 and a 107.5% rise over the past decade. Iron ore exports reached US$ 28.96 billion, a decline of 3.0% from the previous year, but still more than double their level a decade ago.

Meat exports hit a record in 2025, totaling US$ 28.80 billion, up 22.2% from 2024 and 136.6% over ten years. Frozen beef led this expansion, with a 43.2% increase compared to the previous year.

Coffee also reached a historic record, with exports of US$ 14.92 billion, up 31.2% from 2024 and 168.1% over a decade. Sugar exports amounted to US$ 14.11 billion, a decline of 24.2% from the previous year, but still 84.6% higher than ten years ago. Pulp exports totaled US$ 9.17 billion, down 5.8% year over year.

Vehicle exports rebounded strongly, reaching US$ 5.89 billion, an increase of 37.3% over 2024 and 74.9% over ten years.

When trade is analyzed by blocs, the BRICS countries emerge as central. Brazil’s total trade with BRICS reached US$ 251.49 billion in 2025. Today, BRICS account for 40.0% of Brazil’s total trade flow, compared with 13.2% for the United States and 15.9% for the European Union.

This export volume is the main pillar underpinning Brazil’s currency.

It is extremely difficult for any speculative attack on the real to succeed when the country earns such substantial revenues from foreign trade.

Moreover, the sheer scale of Brazil’s trade flow positions the country as a currency power — one of the nations capable of shaping the trajectory of a potential global de-dollarization process.

Brazil’s trade remains predominantly denominated in dollars, but its magnitude means that any signal Brazil sends toward de-dollarizing its foreign trade could have significant implications for the future of the dollar and global finance.